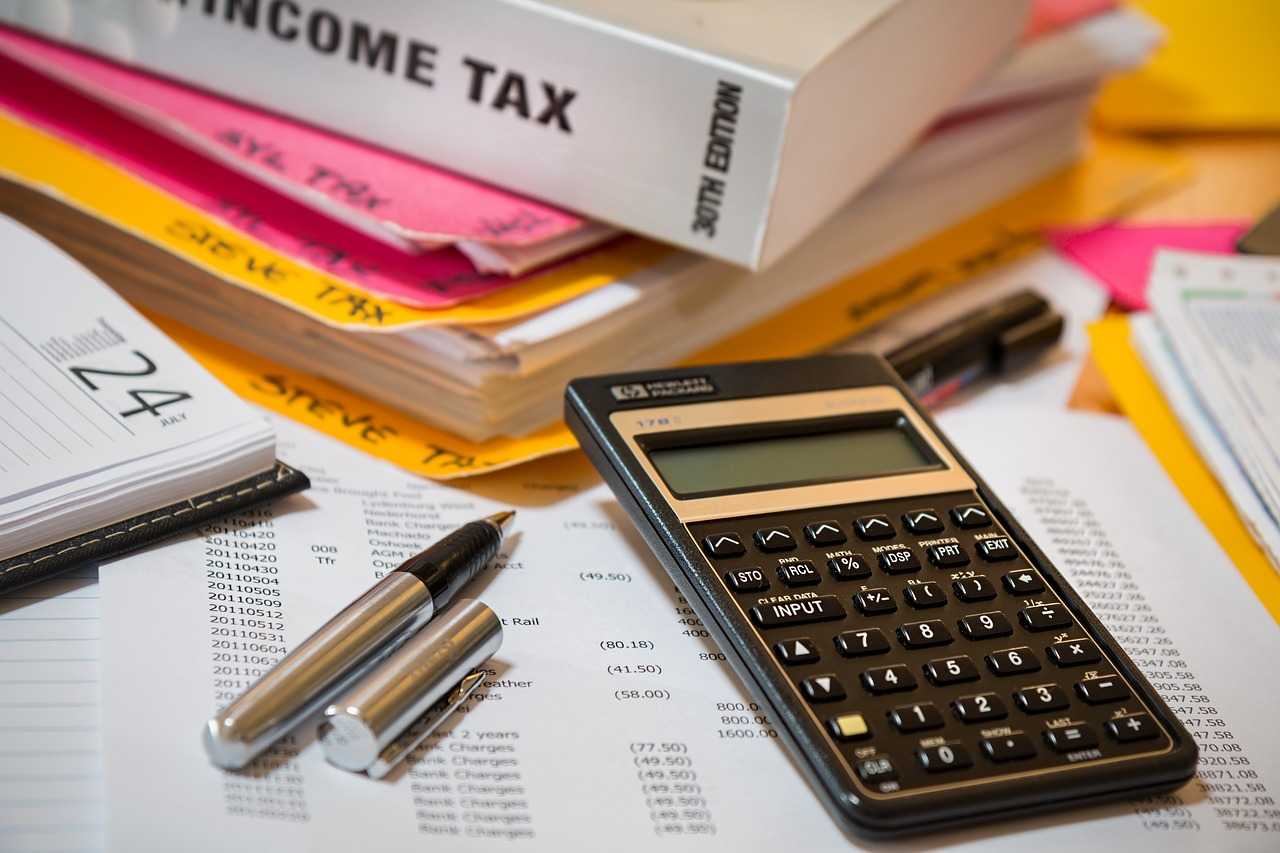

Tax

Navigating the complexities of the American taxation system is an essential albeit complicated part of running a small business. Even though taxes are unavoidable, many lawful strategies let you reduce the amount of money you must pay the government. If you’re interested in learning how to minimize your company’s taxation liability, you’ve come to the right place.

Here are some deductions and incentives available to you, which can help you make more money:

Take tax credits to save money on taxes

A business can be eligible for tax credits for hiring and retaining employees or implementing an environmentally-friendly initiative. For instance, you can benefit from the ERC program if you retained employees during the coronavirus pandemic.

Established under the CARES Act, the Employee Retention Credit (ERC) is available to employers who paid wages to their workers between 12 March 2020 and 1 January 2022. So, if your business was suspended due to COVID-19 or you experienced a drastic decline in revenue, you may be eligible for it. Talk to the professionals at ERC Today to maximize this program’s benefits. Check out the ERC Today fee structure with no up-front cost and the lowest market fees to maximize the benefits of the ERC program. With larger credits, you have to pay smaller fees.

Record business transactions carefully

Adopt the best bookkeeping practices to lower taxes. Statistics show that 90% of startups fail, and the number-one reason behind this is cash flow mismanagement. When you learn how to manage your business funds properly, you can evade the wrath of the IRS and apply for deductions. Some important bookkeeping practices include the following:

- Keep receipts of all business expenses

- Pay your taxes on time without major delay

- Create a proper filing system (online ones are better)

- Always keep your personal and business finances separate

- Avoid mistakes/discrepancies when submitting your tax returns

- Know that different business structures come with different tax benefits

- Maintain open communication with the IRS and respond to their inquiries

Use your vehicle for business purposes

You can deduct 100% of the travel cost if you embark on a business trip. Owning a company vehicle makes you eligible for tax write-offs as well. For the first half of 2022, 58.5 cents/mile is your standard mileage rate which increases to 62.5 for the next half of the year. However, you must log your business miles to get this benefit since it does not apply if the car was driven for personal or recreational use.

These deductible expenses cover the cost of gas, repairs, and maintenance. Moreover, you can get tax write-offs now for any registration, licensing, or rental fees associated with your business vehicle.

Benefit from home office deductions

When working from a home office – a new normal in post-COVID entrepreneurship – you can reduce your taxes by using it as your principal workplace. You’re allowed to deduct certain expenses, such as rent, utilities, insurance, and maintenance of your domestic workplace, to decrease your tax burden.

Similarly, if you’re using a particular part of your house for business purposes exclusively and regularly, that specific portion of the house will help you save money on taxes. Remember that the IRS only allows such deductions if you meet the spirit of exclusivity when working from your home office.

Take tax write-offs for business equipment

You can take tax write-offs on business equipment, such as vehicles, machinery, and even property. But there’s a limit to this type of deduction; as of 2022, the deductible amount can’t exceed $1.08 million.

If you have a piece of equipment used for both business and personal use, it counts as listed property. Listed property is tax-deductible if it’s been mostly used for business purposes. So, you must be extra careful about deducting these business expenses.

Deduct the cost of any gifts you’ve given

Giving away presents to vendors, customers, and other entities for business purposes helps you save money on taxes. You can deduct up to $25 per person for the cost of these business gifts. Packing and shipping, however, aren’t included in this limit (since they add no substantial value to the gift).

Fund retirement plans for employees

Set up retirement plans for yourself and your employees. That’s how you may save a decent amount on taxes. Since different types of retirement plans are available to small businesses, you need to consult a financial expert about which plan aligns more closely with your goals.

The IRS recognizes many different tax-deferred retirement plans, i.e., you won’t pay any taxes on them as long as you are not withdrawing funds from them. So, 401(k)s and 403(b)s are most companies’ preferred plans.

Hire an accountant for bookkeeping

Since 8 out of 10 companies fail due to cash flow management problems, it makes sense to recruit an accountant to maintain your books. Seek referrals from other entrepreneurs if you have trouble finding the right accountant for your company. Consider working with a finance expert working freelance. It’ll help you further reduce the cost of running your business.

Since 20% of small businesses don’t even know their tax rates and some are unaware if any deductions are even possible (the IRS won’t share these details with you), working with an accountant is important to save money on taxes. Hire a person well-versed in tax-saving tricks and strategies.

Conclusion

Entrepreneurs need to pick up effective tax-saving strategies to make the most of their company’s financial resources. From maximizing deductions to taking advantage of tax planning strategies – this blog discusses some amazing techniques to maximize your deductions and save more money for your business. Also, you should benefit from employee retention credit (ERC) while writing off your business trips as tax-deductible expenditures too. That’s how you’ll gather enough money to expand your business in the 2020s.