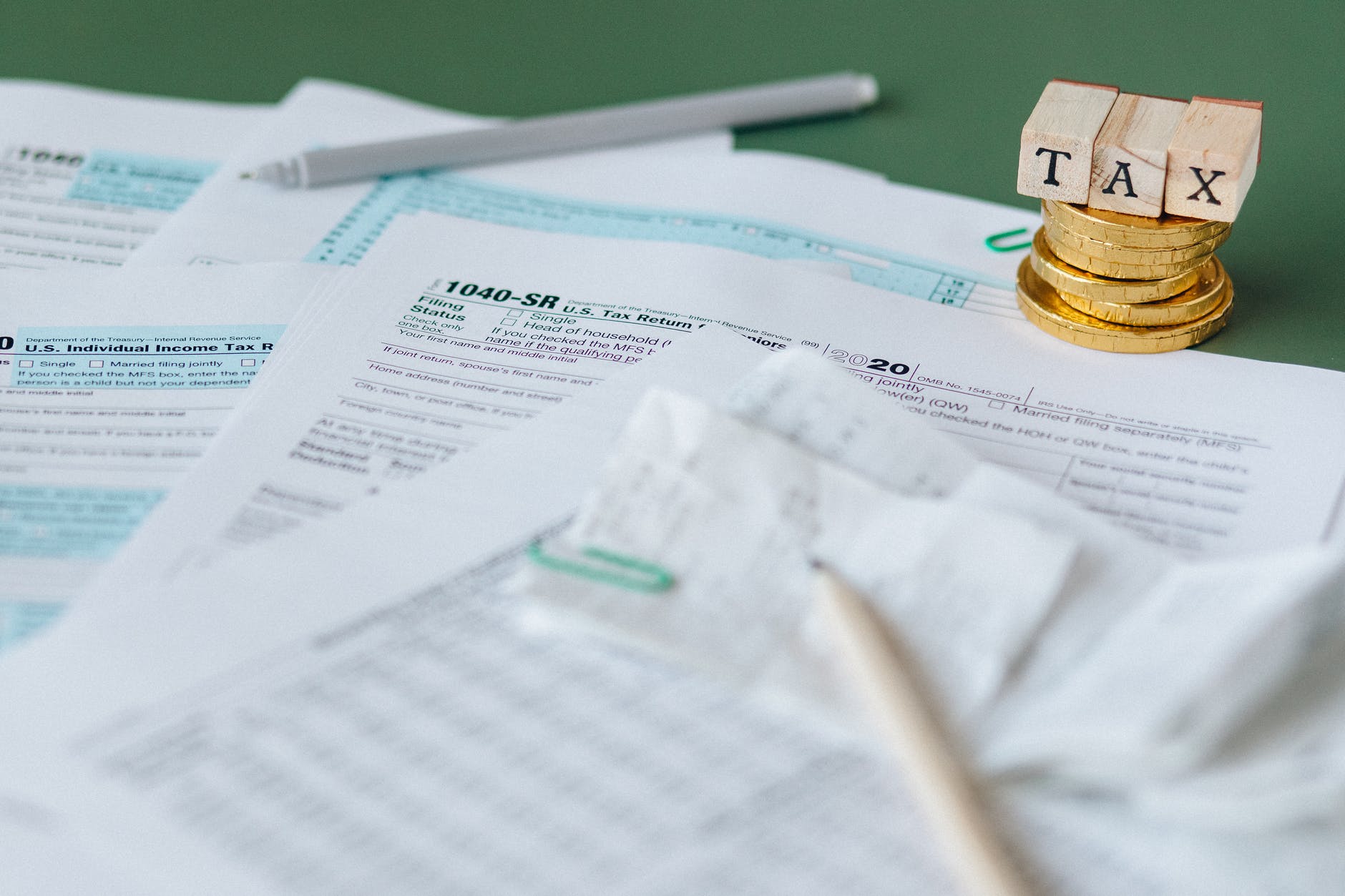

Tax

Navigating the intricate maze of taxes is vital for financial stability and growth. In this comprehensive guide, we unravel the complexities of tax planning, offering invaluable insights to optimize your financial strategies. Whether you’re an individual taxpayer, a small business owner, or an investor, understanding tax laws and leveraging deductions is paramount. We delve into various aspects of tax planning, from smart investment choices to legal tax-saving methods, empowering you to make informed decisions. Get ready to demystify tax jargon, minimize liabilities, and pave the way for a secure financial future.

Taxes influence responsible financial planning by shaping the fiscal landscape in which individuals and businesses operate. By mastering tax intricacies, you not only safeguard your assets but also strategically enhance your financial well-being. Responsible financial planning means utilizing tax knowledge as a tool, enabling you to minimize burdens, seize opportunities, and build a resilient financial foundation. Embracing this understanding transforms taxes from a daunting challenge into a potent resource for your financial success.

Understanding Tax Basics: A Foundation for Financial Planning

Mastering tax fundamentals is the cornerstone of financial success. This section demystifies complex tax codes, outlining the essentials every taxpayer should know. From filing statuses to taxable income calculation, grasp the basics to make informed financial decisions. Understanding tax laws empowers you to plan effectively, ensuring compliance while maximizing your financial potential.

Strategic Investment Choices: Maximizing Returns and Minimizing Tax Liabilities

Delve into the art of strategic investing. Learn how different investments—stocks, real estate, or mutual funds—affect your tax burden. Explore tax-efficient investment strategies, such as long-term capital gains, minimizing taxable events, and utilizing tax-advantaged accounts. By aligning investments with tax objectives, you optimize returns, minimize liabilities, and secure your financial future.

Legal Tax Deductions: Optimizing Your Finances Within the Law

Uncover the world of legal tax deductions, a realm where smart financial choices translate into significant savings. From business expenses to itemized deductions, navigate the permissible avenues to reduce taxable income. By understanding deduction eligibility and substantiation requirements, you maximize refunds ethically, ensuring your financial stability while staying IRS-compliant.

Tax-Efficient Business Strategies: Growing Your Enterprise while Saving on Taxes

For entrepreneurs, strategic business planning extends beyond profits—it’s about optimizing tax efficiency. Explore methods like business structures, deductible expenses to your industry. From small startups to established corporations, discover approaches to enhance profitability by minimizing tax liabilities. Elevate your enterprise while preserving your hard-earned revenue.

When delving into tax efficiency, entrepreneurs often wonder, “Are payroll service fees tax deductible?” The answer lies in understanding the nuances of tax laws. Payroll service fees, which streamline your payroll process, are generally considered operational costs and are, therefore, tax deductible for businesses. By incorporating such deductions into your financial strategy, you not only ensure compliance but also optimize your tax efficiency, further strengthening your business’s financial foundation.

Long-Term Wealth Building: Estate Planning and Tax Efficiency for Financial Success

Planning for enduring financial prosperity involves savvy estate management. Delve into estate tax laws, trusts, and inheritance strategies. Learn to protect assets, minimize tax impacts on heirs, and ensure your legacy thrives. Comprehensive estate planning secures your wealth, allowing future generations to benefit fully. Navigate the complexities with confidence, building not just wealth, but a lasting financial legacy.