Bookkeeping for small business hidden secrets medium Matt Oliver

In this article we will talk about bookkeeping for small business hidden secrets medium Matt Oliver. Many small business owners don’t realize that they can hire a bookkeeper to do the work for them. This will free up time to focus on other aspects of the business, and it will also ensure that taxes are filed correctly. A financial professional can help a business owner with budgeting, taxes, and other financial matters. If the business owner is having trouble finding a financial professional, they can ask their bank or accountant for a referral.

Bookkeeping for small business hidden secrets medium Matt Oliver is necessary to read for any organization. The most important thing to know about business accounting is that it is an art, not a science. Accountants use judgment in making decisions about what information to record and how to record it.

The most important thing to know about business accounting is that it is an art, not a science. Accountants use judgment in making decisions about what information to record and how to record it.

Bookkeeping is a difficult task for small business owners. There are many hidden secrets that can make the process more complicated and time consuming. Here are some tips to help you get a grip on your books:

- Keep a separate checking account for your business, if possible. This will allow you to easily track the money coming in and going out of the business account.

- Track expenses by category so you can see where your money is going.

Bookkeeping is a tedious job and many small business owners would rather not take the time to do it. However, if you want to stay on top of your finances, then it’s an essential task that you’ll need to complete.

It is important to read bookkeeping for small business hidden secrets medium Matt Oliver, small business owners to have a good understanding of the financial side of their company. One way to do this is by hiring a bookkeeper, but there are also other ways that can be more cost effective. It is important to note that it is not always necessary for the owner to know every detail about the finances, it just helps them better understand what they need to do in order to make the company successful.

You Need to Choose the Right Bookkeeping Software

Choose the Right Bookkeeping Software

There are 5 best bookkeeping software to use for your business.

It is very important for a company to choose the right software when making decisions about how to deal with their accounting.

Some things you should consider when choosing an accounting system are costs, cloud or on-premise, training/support, customizations possibilities, and integrations. Consider these factors when deciding what will work best for your business.

It’s important to choose a bookkeeping software that is easy for your business. There are many different types of software available to help you keep track of your finances if you’re a small business owner.

Type of Business Records You Should Keep

Type of Business Records You Should Keep

You should keep records that document your business. This includes:

Financial Records: These include accounting, tax and banking records. These are essential for managing your finances and can be used to make decisions about your future.

Legal Records: These include contracts, agreements and legal proceedings. They are important for protecting you from liability and ensuring that you comply with the law.

Marketing Records: These include social media posts, emails and advertising campaigns.

- Payment Records

- Forms W2 and 1099

- Bills

- Expenses

- Documents that show items of income, deduction, or credit shown on tax return

- Previous tax returns

- Business Deal Records

- Previous tax returns

- Proof of payments

- Financial statements of your accountant or the bank

- Income

- Cancelled Cheques

- Accounts

- Credit cards and bank statements

Benefits of Business Accounting

Business Accounting

The benefit of Accounting in Business is to keep track of the company’s financial position. Accounting is important for business because it helps determine how much money a company has, how much they owe, and what their net worth is. Accounting is the process of keeping track of all the money that comes into and goes out of a business. It is used to measure the performance of a business by tracking assets, liabilities, equity, revenue, and expenses.

Accounting is important for business because it helps determine how much money a company has, how much they owe, and what their net worth is. Accounting is important for business because it provides a way to track the company’s financial data. It also provides a way to forecast the company’s future. Bookkeeping for small business hidden secrets medium Matt Oliver is important in order to know if the company will have enough money for upcoming expenses, such as payroll.

What are the basic Accounting Concepts for Small Companies?

The accounting process is a system of recording and classifying transactions, such as purchases and sales, in order to keep track of the financial position of a business. The two primary types of accounting records are journals and ledgers.

The journal is a chronological record that shows all the details of every transaction that has occurred. Journals are typically used by businesses that use cash-based accounting systems. A ledger is a summary or listing of all transactions in a given period.

The best way to keep your business on the right track is to be organized and meticulous with your bookkeeping. It’s also important to make sure you’re keeping up with tax deadlines.

Make a list of all of your expenses and income, and then categorize them into appropriate folders. This will help you keep track of your spending habits and your profit margins over time.

What are the Hidden Secrets of Small Business Accounting?

Small business accounting is a difficult task. The first thing to do is to get an accountant to help you with your books. They’ll be able to give you the best advice for what you need to do for your company. You can also take a look at this article from Forbes about what it takes to be a successful small business accountant.

Balance Sheet

The balance sheet is the financial statement that summarizes a company’s assets, liabilities and equity. It includes two sections: assets and liabilities. The assets section lists everything of value that the business owns, such as cash, property, inventory and equipment. The liabilities section lists what the company owes: short-term debt (e.g., loans), long-term debt (e.g., mortgages) and other obligations (e.g., employee benefits).

A balance sheet is a statement that summarizes the financial position of an individual or organization at a particular point in time. It lists the assets, liabilities, and net worth of the individual or organization.

The balance sheet is composed of three columns: Assets, Liabilities, and Net Worth. The Assets column includes all of the things that are owned by an individual or organization. The Liabilities column includes all debts owed to outsiders.

Bookkeeping

Bookkeeping is the process of recording and summarizing financial transactions. It is one of the most important functions in any business, as it provides a detailed history of the company’s financial health. The bookkeeping process starts with an initial entry, such as when a product is sold or cash is deposited into the company’s bank account.

Bookkeeping For Small Business Hidden Secrets Medium Matt Oliver

Bookkeeping is the process of recording financial transactions in a company. This includes recording cash received and paid out, as well as the purchase and sale of goods, services, or property. It also records the day-to-day operations of a company. A bookkeeper does not provide financial advice to the company, but instead provides information on how money is being spent. Bookkeeping for small business hidden secrets medium Matt Oliver is the best example to better understanding.

Income

A business income is the amount of money they make per year. Income can come from a variety of sources including sales, investments, projects, and other sources.

The income can be calculated by taking all of your sources of income and adding them together. For example, if you have a job that pays $2,000 per month and you also make money from investments or other sources, then your total monthly income is $4,000. Small business accounting hidden secrets medium Matt Oliver is necessary to get better knowledge about it.

Expenses

An expense is any cost that is incurred in order to derive revenue. An expense is an item or service that you buy in order to use it for a certain period of time. For example, when you buy a new pair of shoes, the cost is an expense because you will be using them for a certain period of time.

I think we should all be honest and upfront with our finances. Just because we don’t want to talk about it doesn’t mean we should pretend like it’s not happening. I’m a big believer in transparency and honesty, and I think that if you’re struggling financially, you owe it to yourself and your family to be as open as possible about those struggles.

Capital

Capital is the money that is invested in a business, it can be any type of investment. The capital can come from an individual, company, or bank. It can be used for many purposes, such as to start a business or to purchase equipment.

Capital is the money that is invested in a business, it can be any type of investment. The capital can come from an individual, company, or bank. Capital is any assets that are used to produce other goods, services, or assets. Capital is money or property that is invested.

Understand and Select Accounting Method For Business

There are two accounting methods: cash-basis and accrual. The cash-basis method records income when it is received and expenses when they are paid. The accrual method records income when it is earned and expenses when they are incurred, regardless of whether or not the money has been received or paid.

Bookkeeping For Small Business Hidden Secrets Medium Matt Oliver

You need to learn bookkeeping for small business hidden secrets medium Matt Oliver because the accounting method that is most appropriate for a company will depend on the nature of its business. For example, if a company manufactures products and sells them, it would be appropriate to use the accrual basis of accounting as opposed to the cash basis. A company might also choose to use the cash basis of accounting if it needs to conserve cash.

Accrual Based Accounting

Accrual-based accounting is a type of accounting that is used to determine the financial position of a business. The process involves the matching of revenues and expenses over a period of time, such as a year. In contrast, cash-based accounting only records cash transactions and does not include non-cash transactions.

The accrual basis of accounting records any revenue or expense that has been earned or incurred regardless of whether or not it has been paid for or received.

Cash Basis Accounting

Cash basis accounting is a type of accounting system where the business only records transactions when cash changes hands. This means that any transactions which do not involve cash, such as credit card payments, are not recorded on the books.

Cash basis accounting is a type of accounting system where the business only records transactions when cash changes hands. This means that any transactions which do not involve cash, such as credit card payments, are not recorded on the books.

Accounting Control Checklist

1. Have the accounting records been examined for completeness and accuracy?

2. Are current accounting procedures being followed and are they adequate for the company’s needs?

3. Has the accounting system been designed to provide for timely and accurate financial information?

4. Is the accounting system adequate to handle changes in volume of business, product mix, or organizational structure?

5. Are there any deficiencies in internal control that need to be corrected immediately?

Monthly Accounting Tasks

There are many monthly accounting tasks, but the two most important are the closing process and the preparation of financial statements. You can learn more bookkeeping for small business hidden secrets medium Matt Oliver for better understanding.

The closing process is a set of steps that must be followed to ensure that all transactions are recorded and accounted for in the correct period. The preparation of financial statements includes compiling information from the general ledger, which is an organized list of all assets, liabilities, equity, income, expenses and gains or losses.

1. Reconcile bank account balances to the general ledger.

2. Prepare a trial balance for the current month.

3. Post all journal entries from the current month to the general ledger, including adjusting entries and correcting errors.

4. Prepare a balance sheet for the current month.

5. Prepare an income statement for the current month.

Small Business Accounting Hidden Secrets

Accounting is not as difficult as it seems. The most important thing to remember is that there are two types of accounting: cash and accrual. Cash accounting only records the money that has been spent, whereas accrual accounting records the money that has been spent and also the money that will be received in the future (such as when a sale is made).

Accounting is the process of documenting the financial transactions in an organization. It is also the process of summarizing and analyzing these transactions in order to provide information about the business’s financial situation.

Accountants will need to use their skills in math, logic, and communication to maintain records in accordance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

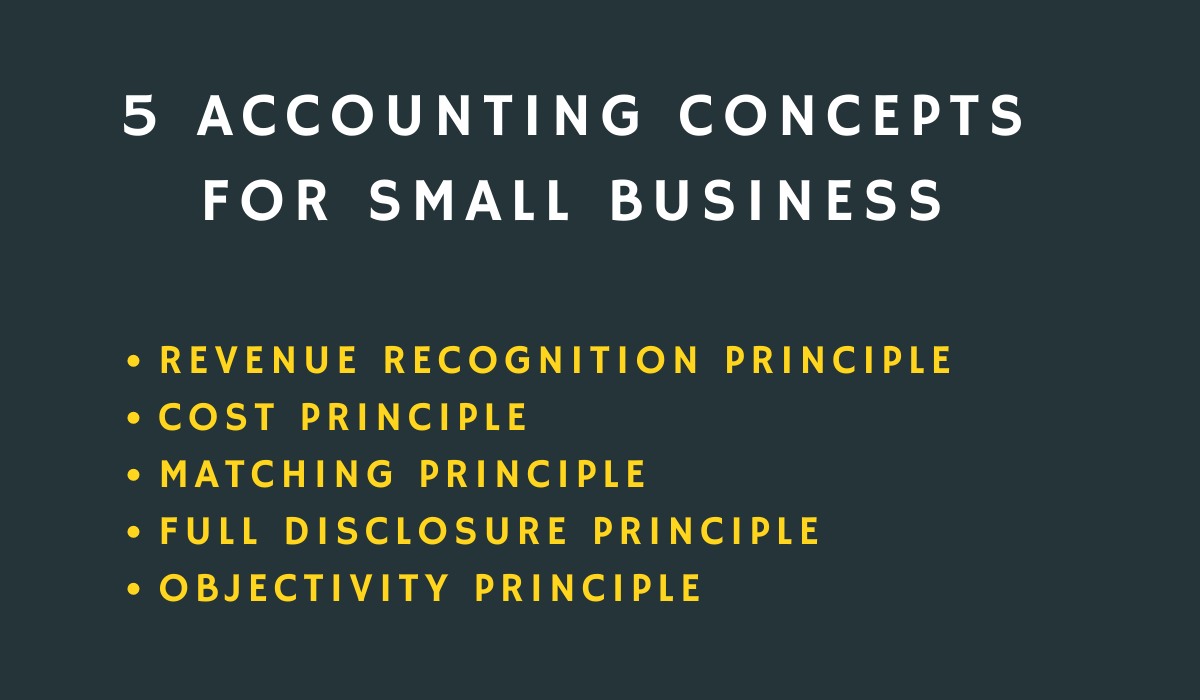

5 Accounting Concepts For Small Business

Accounting Concepts For Small Business

- Revenue Recognition Principle

- Cost Principle

- Matching Principle

- Full Disclosure Principle

- Objectivity Principle

Accounting concepts vary depending on the size of your business and how you want to use the information. If you need to know which accounting system will give you the best information for your needs, consult a CPA.

Accounting is a very important part of running a small business with accounting hidden secrets medium Matt Oliver. There are many concepts that need to be understood and used correctly in order to ensure that the company’s finances are managed effectively.

A key concept is the difference between cash and accrual accounting. For cash accounting, transactions are recorded as they happen, while for accrual accounting, transactions are recorded when the money is actually received or paid out.

Bookkeeping For Small Business Hidden Secrets Medium Matt Oliver

There are many accounting concepts that small business owners need to be aware of in order to maintain accurate records. These concepts can be complicated and overwhelming, but by understanding the basics and putting in the time and effort, small business accounting hidden secrets medium Matt Oliver is a secret of getting success in the field. Small business owners can make sure they are on top of their books.

Final Words

In conclusion, the most important thing to remember is that it’s never too late to take care of your business’ finances. In order to keep a proper record of any transactions, you need a reliable bookkeeping system in place. You can’t afford to neglect this duty or else you’ll be dealing with a world of regret and regretful decisions.

If you’re a small business owner, this article has some helpful tips on getting organized with your bookkeeping. Follow the advice in this article to get started today!

If you’re a small business owner, now is the time to invest in a bookkeeping system that meets your needs and read bookkeeping for small business hidden secrets medium Matt Oliver, this article offers some great advice to small business owners – read it, and share it.